46+ can i deduct mortgage interest on second home

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web If youve closed on a mortgage on or after Jan.

Primary Residence Value As A Percentage Of Net Worth Guide

Web Generally for the first and second categories you can deduct mortgage interest on up to 1 million 500000 for those married filing separately.

. Learn More to Start Today. That means for the 2022 tax year married. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately.

Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second. Married filing jointly or qualifying widow er. 18000 for heads of household.

Web Yes and maybe. Now the loan limit is 750000. Get More Out Of Your Home Equity Line Of Credit.

Web You can deduct property taxes on your second home too. However the deduction for mortgage interest. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web For 2021 tax returns the government has raised the standard deduction to. As long as you dont rent out a second home for more than 14 days each year you can deduct the mortgage interest you pay on it.

As noted in general you can deduct the mortgage. Web If you have two homes you can still deduct the mortgage interest on your federal taxes on a second home. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible.

Web Is there a limit to the amount I can deduct. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest. If you rent out your second.

Yes you can include the mortgage interest and property taxes from both of your homes. Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

To qualify the property must be listed as collateral on. Web March 5 2022 246 PM. Web If your mortgage originated on or before December 15 2017 congratulations you are grandfathered into the prior tax treatment and may deduct interest on up to 1000000.

Loans and expenses that qualify Mortgages used to buy a primary home or second home including refinanced mortgages Important rules and. Web Whats deductible. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

Single or married filing separately 12550.

Can I Deduct The Mortgage Interest On A Home I Own In Which A Family Member Lives

Are Second Mortgages Tax Deductible The Tipton

Deduct Mortgage Interest On Second Home

Top Tax Deductions For Second Home Owners

Can You Deduct Mortgage Interest On A Second Home Moneytips

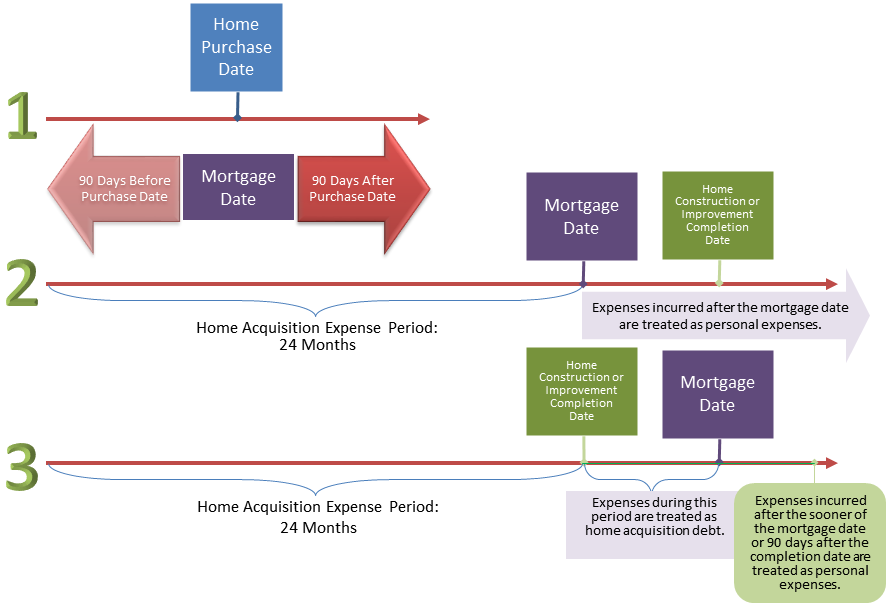

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Second Home Tax Benefits You Should Know Pacaso

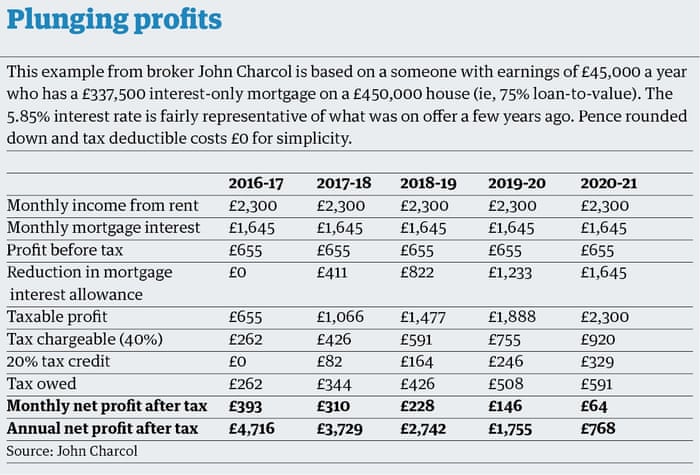

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Deduct Mortgage Interest On Second Home

3 Things You Need To Know About Second Home Tax Deductions

A Guide To Business Relocation In Europe 2012 13

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

News

Can You Deduct Mortgage Interest On A Second Home Moneytips

What Is Considered A Second Home For Tax Purposes Pacaso

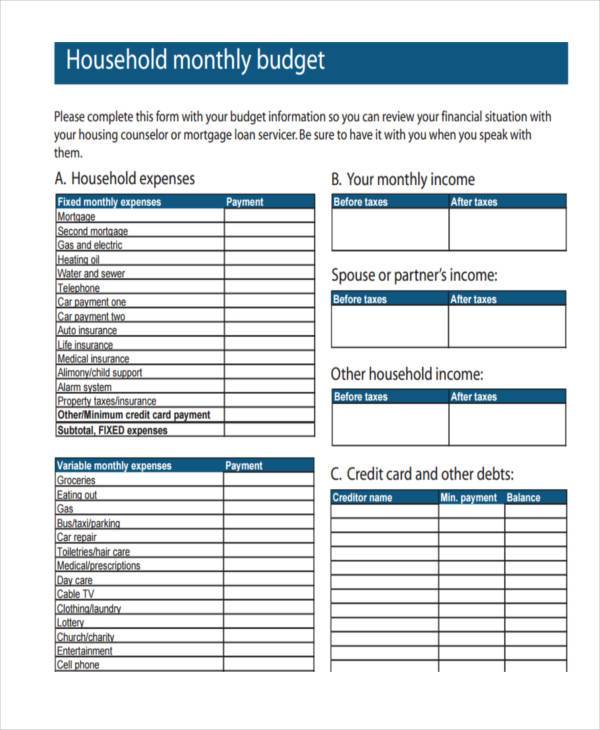

Free 46 Budget Forms In Pdf Ms Word Excel